In the market to buy or sell a home?

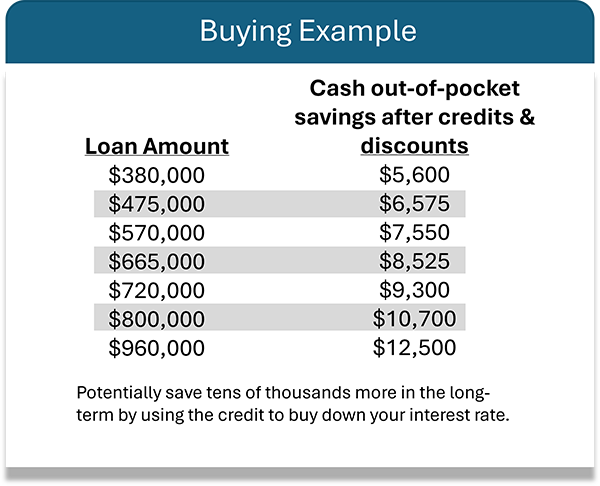

As an employee of a DHA Select organization, our Dream Home Advantage program puts money back in your pocket when you buy or sell a home. With Dream Home Advantage, you could receive 1% or more of your loan amount back when buying a home, up to $20,000. Plus, you’ll pay ZERO loan origination fees, ZERO loan processing fees and ZERO loan underwriting fees for an additional savings of $1,500 or more.

Program Details

- For employees and family members of DHA Select organizations

- There is no recapture period, meaning you never pay the money back

- Apply your credit towards closing costs, rate buydowns, or pre-paids

- No interest rate adjustment – you will not be given a higher rate to receive the credit

- No area or income restrictions

- Immediate and extended family members are eligible to receive 50% of the benefit

- DHA Select organization employment is the ONLY requiremet to qualify for the program

- Secondary and investment properties are eligible

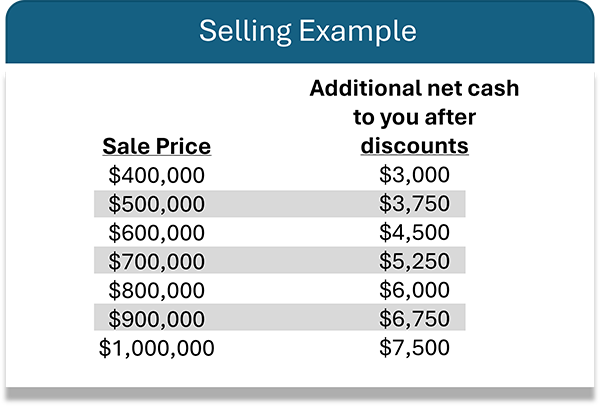

Scenario Examples

If buying and selling, both scenarios can be combined to save thousands more!

Frequently Asked Questions

Do I have to pay the credit back?

The credits and/or discounts are not added to your loan amount, nor rolled into your interest rate, therefore you do NOT have to pay it back.

Can the credit only be used towards closing costs?

NO, it can also be used towards a rate buy down, pre-paid items such as taxes and insurance, or a combination of all three.

Do I need a higher credit score than what government or agency guidelines require for this program?

NO, you do not.

Does it matter how much I make?

There are NO income limits. As long as you qualify for a loan, you can receive the benefit.

Are educational courses required to receive the benefit?

NO, they are not required; however, they are available and recommended.

Are there limits to the purchase price or area restrictions?

There are NO purchase price or area restrictions.